~ Consumers can delay repayments by 4-7 days at no cost, helping to improve cash flow and financial wellness ~

~ Using Open Banking technology, Zilch will proactively recommend Snooze to customers who would benefit most from it ~

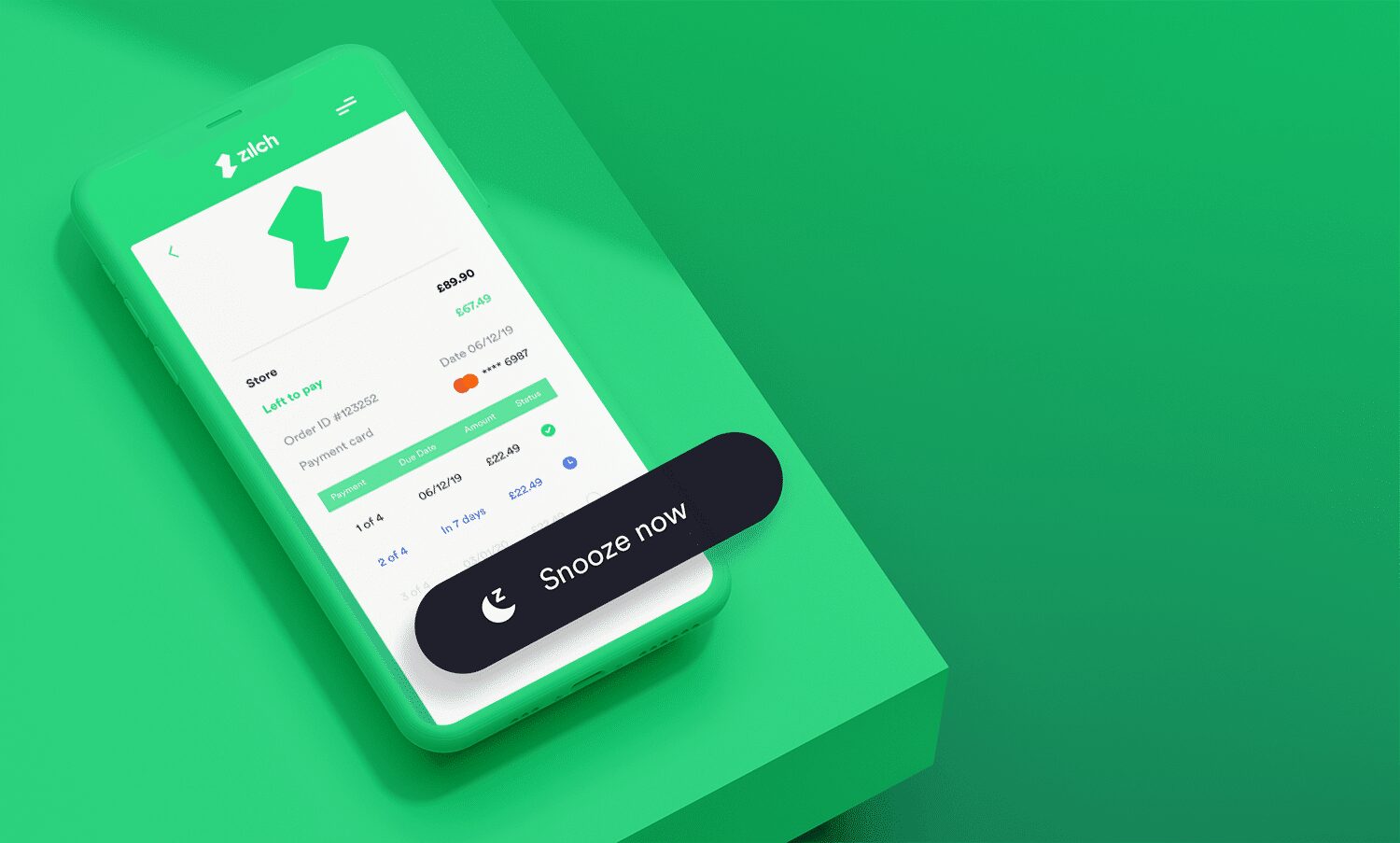

London, 17. November 2020 – Zilch, a London based start-up redefining the Buy Now, Pay Later (BNPL) market, today launches it’s latest market leading feature – Snooze. Using opening banking, Snooze grants consumers the power to affordably delay repayment on an installment, or an entire payment plan, by 4-7 days – for free. No interest, no hidden fees.

This is another step taken by Zilch to place consumers in a position of power to proactively manage their cash flow, reduce financial stress and maintain financial wellness.

Philip Belamant, Zilch founder and CEO at Zilch, said, “At Zilch, we build every new feature with the customer front of mind. We understand 2020 has been a year like no other – people have lost their jobs, changed roles or been furloughed through no fault of their own and, as a result, their income has been affected with little warning. It’s more important now than ever to provide our customers with a proactive way to inform us that they need more time to complete a payment or need to tweak the repayments schedule. Snooze is a quick, simple and free way to do this without having to spend time on the phone/chat/email to a support team.

Ultimately, giving our customers this option not only increases their control over cash flow, but also significantly reduces the chances of missed payments, removing any credit-related anxiety and increasing financial wellness. It’s a win win all round.”

Using innovative Open Banking technology combined with soft credit checks to assess an up-to-date view of customer affordability, Zilch will be able to offer this feature in real time. If Zilch is alerted to an impact on customer earnings, it will proactively suggest Snooze if it determines this is the best course of action to improve a customers cash flow position.

The FinTech already alerts users when payments are due ahead of time to better help them plan their weekly and monthly cash flow. By combining this with Snooze, Zilch is building upon its mission to champion the needs of customers by placing them in control of payment management. Now Zilch customers can make payment early, snooze a payment or sit back and let Zilch automatically collect it – all for free.

Zilch is the newest player to enter the BNPL market and the first over-the-top solution – but takes responsibility and offers transparency some traditional BNPL players don’t embrace. As the only player in the industry that uses Open Banking technology, Zilch has a real-time view and understanding of the consumer’s affordability profile and makes the accurate recommendation of what they can afford, preventing debt.

Zilch is merchant agnostic and enables its customers to shop wherever Mastercard is accepted and spread their payment over 6 weeks for zero interest and zero hidden fees. Described by reviewers as ‘the next shopping revolution’ Zilch offers customers a virtual MasterCard token that can be used anywhere the customer chooses including Amazon, eBay, iTunes, GAME, Carphone Warehouse, Sports Direct, Adidas, Hype, Topman, Nike, Boohoo, UGG, and ASOS.

For more information, visit: https://www.zilch.com/uk/

ABOUT ZILCH

Zilch is the new FinTech darling of the UK – Born in London, it’s unique “Over-The-Top” platform is the first of it’s kind in the fast-growing Buy Now Pay Later (BNPL) space.

By taking accountability for its customers, Zilch removes the anxiety associated with credit. It’s proprietary data-driven credit assessment technology focuses on optimising its users’ cash flow whilst preventing over indebtedness. Zilch is growing at lightning speed with quarterly growth exceeding 120% and monthly registrations now at 20,000. Unlike other players in the BNPL space, Zilch’s merchant agnostic proposition offers its users unrestricted access to the entire online retail space, so they can shop wherever they choose to do so. Wanna buy it? Zilch it!